Currency War - The Non Shooting Proxy War That Could Prove More Lethal Than Bullets

Click any title to skip to the article

What the Latest Currency 'War' is All AboutDoes It matter If The Dollar Is Replaced?

Sanctions have failed, the Russian rouble is stronger than before the war

Euro Challenges USDollar As Global Currency

E U Central Bank Digital Currency Is The Death Rattle Of A Failed Experiment Europe to ditch US dollar in payments for Iranian oil?

Massive Boost To China’s Petro-yuan As Iran Ditches US Dollar In Oil Trade

China's Low Key Launch Of Its Challenge To Petrodollar Supremacy Soros Declares War on Bitcoin In Speech At World Economic Forum In Davos

Chinese Silk Road Plan Will Impact Western Trade

Europe Prepares To Join The Currency War Currency Wars: Former UN Under-Secretary-General Calls For One World Currency

De - Dollarisation: More Nations backing Away From The US$ Russia Says Time Has Come To Ditch The Dollar

Russian Gold Reserves Hit Putin-Era High, Buying Frenzy Accelerates

How Russia plans to disentangle its economy from US dollar

Russia-China return to gold standard means end of US dollar dominance

The Death Of Petrodollars & The Coming Renaissance Of Investing

U.S.A. Threatens To Cut Off China From The US Dollar If They Do Not Uphold Sanctions On North Koreas

Russia & China Declare All Out War on US Petrodollar

The Demise Of Dollar Hegemony: Russia Breaks Wall Streets's Oil-Price Monopoly

Another Oil Exporting State Surrenders: Last Nail In Petrodollar's Coffin

China launches global yuan payment system

US Becoming Isolated As Key Ally Japan Considers Joining China-Led Investment Bank

De-Dollarization Accelerates As More Washington "Allies" Follow Australia To China-Led Bank

China Becomes Global Lender Of Last Resort With Bailout Of World's Most Indebted Oil Company

What the BRICS plus Germany are really up to in the Currency Wars?

De-Dollarization: Russia Ratifies $100 Billion BRICS Bank

De-Dollarization Accelerates: Russia Launches SWIFT-Alternative Linking 91 Entities

Swiss Decoupling Sets The Euro Adrift, Triggers Vast Losses For Banks, And Currency Traders

Russia Propositions Europe: Dump The US$ And I'll Show You My Eurasian Economic Union

Oil price: Britain's North Sea Oil Industry 'Close To Collapse'

The Dollar Versus The Rouble

China Stumps Up To Help Beleagured Russian Economy

Is The World About To Return To The Gold Standard?

Is The Chinese Cavalry About To Ride To The Rescue Of Russia's Economy

Don’t believe American lies about Russia

China-Russia currency agreement further threatens U.S. dollar

War On Terror - omnibus page

[ a href="http://www.greenteeth..com/latest-posts.shtml">Latest Posts ]

Sanctions have failed, the Russian rouble is stronger than before the war

Looking at the financial data earlier today I noticed that the Russian rouble is now worth more against the US dollar than it was before conflict broke out in Ukraine. On the 22nd of February this year, one US dollar would exchange for just over 79 rubles. As of the time of writing, it is now 78.

The same is true of the UK pound (still a reserve currency and actually gaining popularity as the US$ and the European €) which stood at around 108 rubles before the war and is 102 now, while the Euro traded at 88 rubles before, and is 84 now).

Around the world the ruble is stronger than before the war, particularly among those nations that have refused to support santions. but we are still being told on a daily basis that the US /NATO / EU sanctions are crippling Russia economically So, what is going on and why are we being lied to again?

The media are attempting to throw a cloak of invisibility over their propaganda falsehoods by claiming that the current strength of the ruble “may be illusory” or that Russia has exploited a “loophole” in the sanctions and used “financial alchemy” to “rescue the ruble”.

This is bollocks, Russsian exporters are avoiding sanctions by using methods that are standard business practice, they are trading through middle men. It was obvious from the moment sanctions were imposed that Russia and its customers would continue to do business through companies trading under the banking equivalent of a flag of convenience.At the same time, Europe and the US are expecting food and gas shortages, seeing record petrol prices and talking about rationing. And mainstream media claim Ukraine is winning the shooting war and sanctions are destroying the Russian economy and stirring up public unrest and demands for Putin to be removed from office.

Last week OffGuardian.com published an article asking “Is Russia the REAL target of Western sanctions?”

As the war continues, and the ruble strengthens, while food prices and energy costs in Europe, North America spiral out of control as the establishment try to keep the COVID fear and panic bandwagon rolling the answer is becoming pretty obvious. We The People are the target of all these manufactured shitstorms, the objective behind them is less obvious. but the guess of most habitual sceptics like myself is that we are being softened up for the creation of a totalitarian world government.

EXPLORE:

[Daily Stirrer] ... [ Our Page on on Substack ]... [Boggart Aboad] ... [ Greenteeth Home ] ... [ Greenteeth on Minds.com ] ... [ Here Come The Russians ] ... [ Latest Posts ]

Euro Challenges USDollar As Global Currency

Our currency wars feature has taken a back seat these past two years as the COVID pandemic (or propaganda pandemic as some people might say,) has pushed all other stories aside. In our opinion however, the pandemic has served as a convenient smokescreen behind which all sorts of elitist skulduggery has been going on, hidden from the view of the general population.

In Europe, Brexit is done and dusted, the UK economy though hit by the irrational and panic stricken responses to the pandemic as all other major economies have been, is doing well while the European Union (EU), the globalist project aimed as completing the trio of superpowers needed to create an Orwellian dystopia, seems to be falling apart politically and economically. Well we Brits always knew Europe needed us far more than we needed Europe.

And as if to confirm this, the UK£ has been doing remarkably well in currency markets.

It is somewhat surprising then that investment bankers Goldman Sachs this week predicted that the Eurozone would grow at a faster pace than the U.S. in 2022, predicting growth 4.4 percent for EU and only 3.5 percent for U.S. GDP. The latest World Bank forecast, also from January, still sees the U.S. ahead, if only by a paper-thin margin of 0.1 percent, while the new IMF outlook is yet to be released.

As our finance expert Phil T. Looker always likes to remind us GDP is a next to useless measure of real economic health as it only measures the level of churn in an economy. The old analogy is Joe wins $500 on a scratchcard, so the pays Jeff the mechanic the $500 he owes for car repairs. Jeff takes the cash and pays Simon the accountant for sorting out his little problem with the Taxman. Simon decides his office is looking a bit dingy and hires Will the decorator to freshen up the decor. Will passes the money on to Mandy the prostitute in gratitude for her comforting him when his wife left, his mother was sent to prison and and his dog died all on the same day. Mandy looked in the mirror, decided her face was looking a bit tired and spent the money on a spa day. And the beautician, feeling lucky, blows the whole lot on scratch cards.

So Joe's $500 has increased GDP by $3000 yet no extra wealth has been created. But hey - ho, in a system reliant on fiat money, as John Steinbeck wrote, "The monster must grow or else it dies, and for it to grow the monster must be fed," and measuring the heath of the economy by GDP is how we feed the monster. Thus 'growth' is the keyword even though ALL major economies the rate of price inflation is higher than the rate of growth, thus they are in fact contracting and all but the super rich are becoming poorer. But bankers make the rules not us, so on we go.

While mainstream business journalists are still arguing over who will trump whom for economic growth this year, Statista's Katharina Buchholz notes that there are other indicators that already show the Eurozone’s growing economic prowess and international importance.

While the Eurozone has seen output stagnate its single currency, The Euro has been doing quite well. The value of global transactions settled in Euro has been slowly gaining ground on the sum total of UD dollar transactions, data from the Swift international payment network indicates, hinting at increased activity around the currency.

In October 2020, Euro transaction value briefly moved ahead of the U.S. dollar, while in the longer term the gap between the two currencies on the world stage has become considerable smaller since the start of the coronavirus pandemic.

Goldman Sachs report that reasons for this include the EU’s coordinated efforts to prop up its economy in the current crisis and its continued zero-interest fiscal policy, both of which can only be harmful to the collective EU economy in the long term, and that since the inauguration of the economically illiterate Biden regime in Washington D.C. faith in the U.S. economy and its future prospects is crumbling. According to CNBC, uncertainty around President Joe Biden’s “Built Back Better” economic package continues to harm confidence in the USA, while far left lunacies like the Green New Deal threaten to bankrupt the Us economy while achieving nothing other than to score points with climate change whingers like Greta Thunberg and the unwashed crusties of Exstinktion Rebellion.

Here's an inforgraphic lifted from Statia showing the narrowing of the gap between Euro and US dollar transactions.

You will find more infographics on the topic at Statista

Looking at only payments between parties from different currency zones – thereby excluding international payments between different Eurozone countries – the U.S. dollar still retains its edge as a global trade currency. The gap to the Euro stood at around 3 percent of transaction value in November 2021. Yet, economists have shown surprise at the Euro’s general international success as a strong second player since the U.S. dollar was long seen as the singular international trade currency.

It is also worth mentioning that another reserve currency is performing strongly though on a smalled scale. The UK pound, though by no means a challenger to either Euro or Dollar is the forgotten currency of the bunch, and for decades has been used mainly for trade between nations in the British Commonwealth, (which represents about a third of the global population mainly due to India, Pakistan, Nigeria and Bangladesh being members. The reasons for this small rally in the popularity of the £ are less clear but as we have reported extensively elsewhere in this page, The People's Republic of China has been busy trying to promote its Yuan (Renminbi) as a reserve currency so it could be that both the Euro and The Pound are benefitting from smalled economies fear of getting too deeply in hoch to the predatory superpowers, The USA and China.

RELATED:

Even If The War In Ukraine Ends, Sanctions Will Stay - So How Bad Will The Food Crisis Get?

Western leaders, desperate to show their own countries they were taking a firm stance on Russia's invasion of Ukraine, were quick to impose economic sanctions ... so quick in fact that they acted before they had though things through. While freezing Russia out of the global finance system they have exacerbated the wests energy crisis, while Russia's retaliatory ban on raw materials (fertiliser) exports will create extra problems on top of those we already had ...

[Daily Stirrer] ... [ Our Page on on Substack ]... [ https://www.originalboggartblog.wordpress.com/">Original Boggart Blog ] ... [Boggart Aboad] ... [ Greenteeth Home ] ... [ Greenteeth on Minds.com ] ... [ Latest Posts ]

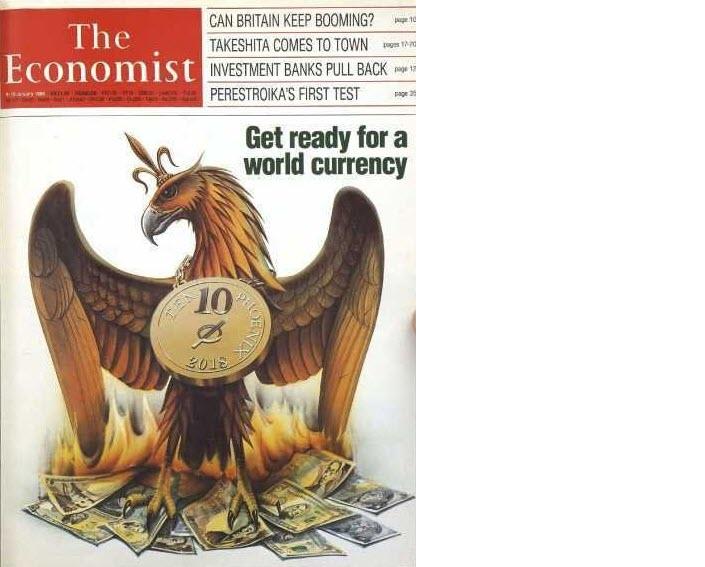

Towards "One" World Currency

based on https://www.zerohedge.com/economics/towards-one-world-currency Most people in the western nations (including outposts like Australia,) think they prefer democratic government to any other kind, but recent behaviour has revealed an ugly truth, that about half of the populations in those democratic nations will gladly surrender their rights and liberties to tyrannous authoritarianism simply because the powers that be have generated and maintained a scare story about a killer virus which does not actually kill verty many people or even cause moderately serious illness in most of us. This suits the leaders of our democratic nations of course because recent events have also shown that all governments in this, the 21st century of the Common Era, Democracy or socialism, Communism or fascism, theocracy or technocracy, they all share one common feature, the desire to dominate populations, limit individual and societal freedoms and control the minutiae of peoples' lives . While seen as vastly different systems with distinct goals, each is rooted in the premise that people should sacrifice freedom and personal sovereignty for "the greater good." The biggest problem with democracy is that it allows a simple majority to force their ideas and values on others. This is why our forebears created systems of checks and balances, including separation of administrative, legislative and judicial branches of government in national constitutions. However, even these no longer guarantee freedom will remain. In the European Union we have oberved the progressives centralisation of power and the transfer of member states sovereign rights to an unelected committee of bureaucrats, in The USA and UK recent cases have revealed the Supreme Courts of those nations, once the defenders of liberty and upholders of the tradition that all are equal before the law, have been corrrupted by money and power and now decide cases according to political and corporate patronage rather than impartial application of the law as it stands. In nations such as Ukraine (twice), Lebanon, Serbia, Myanmar and arguably the USA in 2020, we have seen colour revolutions, sponsored by external players, lead to regime change and the replacement of democratic governments with authoritarian regimes which rule by decree. Over time our central banks and financial systems and institutions have been corrupted by similar influences, crony capitalism and a political system that aids encourages corporate businesses with fascistic ambitions to create near monopolies, in return for their cooperation in extending the sureveillance, control and propaganda activities of the state. It could be argued that those in power don't have to take away our freedom by force if we are willing to surrender it or trade it for empty promises of protection from not-very-deadly "killer" diseases. Nor do they have to be fair in how they go about this if they simply get a majority of the populace to go along with their plan. And one of the easiest and cheapest ways to ensure the complicity of the populace in their own subjugation is through fear. ****** The suspicion governments are self-serving creatures is apparent in the old school British imperial definition of “commerce” which used free trade as a cover for the military dominance of weak nations. Those put in a position of being exploited often saw this as simply a ruse promoted by those wishing to abuse them. In short, opening borders and turning off protectionism simply makes it easier to rob countries of their wealth. America, a wayward child of England, has been accused of following this same path. In my last article titled, "The first Global Inflationary Depression Is Possible" a case was made that the world was headed towards an economic crisis due to several factors. The problem is that such a scenario encompasses all aspects of life, from food and energy, to supply chains, geopolitics, and possibly even war. This article is an effort to offer up some ideas on how governments might respond to such an event based on current trends and some of the events that have occurred during the covid-19 pandemic. If we accept the idea that governments are self-serving and that a huge majority of the people suffer during an economic depression, we should expect frictions to develop as the populace seeks solutions to ease their pain. Sadly, governments across the world have overreached and crushed the rights of individuals during the pandemic. People have been denied the ability to travel, locked in their homes, followed by drones, and even been jailed. This may have been just a taste of what we might expect if governments are put under pressure to perform. Many people have pointed to the fact that in the past "war has been the go-to answer" often used to take our eyes off of problems. Hopefully, that will not be the case, however, many of the other options possible in the age of almost total surveillance do not seem much better. It is wise to remember that when all is said and done, those in power will not be kind to us but they will rapidly throw us under the bus without a thought. Silencing dissidents or those that protest or disagree by limiting free speech is only a start. Lock-downs and curfews take on a whole new meaning when harshly enforced. They can include things like house arrest, cutting power, links to the internet and communication, and even water to areas where unrest gets out of hand. You can expect governments to remove anything that gives us the power to control our fate. [Daily Stirrer] ... [Boggart Aboad] ... [ Greenteeth Home ] ... [ Medium.com ]Europe to ditch US dollar in payments for Iranian oil?

Whisper it very quietly. The European Union is planning to switch payments to the euro for its oil purchases from Iran, eliminating US dollar transactions, a diplomatic source told Russian news agency RIA Novosti. If this is true the move should come as no surprise as this blog reported in 2016 that as a result of Russian and Chinese efforts to set up an alternative to the US dollar as the medium of exchange for bilateral trades, the EU was among many parties expressing willingness to use the new system.

Brussels has recently been at odds with Washington over the US withdrawal from the Iran nuclear deal, signed by the Obama Administration. President Donald Trump, badly advised by the State Deptartment and The Pentagon, has moved to re-impose sanctions against the Iran. According to many well informed sources the US action is in preparation for a regime change campaign against Iran. The EU may be displaying atypical sanity by indicating it wants nothing to do with such adventures after the debalces in Afghanistan, Iraq, Libys, Ukraine and Syria.

Earlier this week, EU foreign policy chief Federica Mogherini revealed that the foreign ministers of the UK, France, Germany, and Iran had agreed to work out practical solutions in response to Washington’s move. The bloc is reportedly planning to maintain and deepen economic ties with Iran, which will include increased trade in oil and gas supplies.

Mogherini said the sides should work together on removing sanctions as part of the historic nuclear deal. “We're not naive and know it will be difficult for all sides,” she said.

The lifting of international sanctions two years ago allowed Iran to sell its oil in the world’s markets for the first time in nearly four decades. Since then, Tehran has managed to significantly increase its exports of crude although the bulk of its oild trade remains with China and other non aligned nations.

Oil is pegged to the US dollar on international markets however, making it difficult for Iran’s partners to make payments for crude and for Tehran to receive them. With the dollar playing the leading role on international financial markets, re-imposing sanctions would mean cutting Iran off from the global financial system. This is where China's new petro - yuan trading system on the Shanghai commodities market becomes a game changer. Nations are no longer dependent on US approval for their trades.

Dozens of contracts signed between European businesses and the Islamic Republic could be at risk of cancellation if Brussels obeys Washington’s reimposition of sanctions. This would damage Iran’s economy and European firms would lose a huge market in the Middle East. Switching to alternative settlement currencies allows both sides to continue trading despite US sanctions.

RELATED POSTS:Will Commodities Be The New Reserve Currency As The Death Knell Of The Dollar Sounds?

Many respected economists and market analysts who favour the free markets approach concur that we are heading towards a new economic reality that will see the collapse of the US$ as the default reserve currency, to be replaced not by any other fiat currency such as the Euro or the Renminbi, but by a system in which commodities are the

primary denominator of value. Should this turn out to be the case we can expect an acceleration of the shift in geopolitical power from west to East.

We The Good Guys Versus They The Bad Guys Reporting Does Not Make Sense For The Ukraine Crisis

Mainstream media reporting of the conflict in Ukraine has disappointed. Perhaps I was naive to suppose that lessons might have been learned from the hits their print sales and online traffic rates took as a result of their handling the COVID pandemic But instead of focusing on the most obviously newsworthy aspect of the build up to and escalation of the war, Russia’s view of NATO expansion into Ukraine and even further to Georgia and Kazakhstan, news reports have simply demonised Russia and portrayed Ukraine as the good guys.

Europe's Depleted Gas Storage Might Not Get Refilled Ahead Of Next Winter

While mainstream news reporting of the conflict in Ukraine continues to pump out a torrent of anri - Russia, pro - war propaganda the catastropic effects of this war that could so easily have been avoided are not mentioned. Well why would warmongering governments admit they have inflicted an energy crisis, food shortages and soaring living costs on their people for no good reason ...

Russia Just Sent out a Message NATO Should Better Listen To

The key paragraph from the latest official Russian naval doctrine is that Putin and his military advisers have sent a clear message that NATO encroachment is unacceptable. To be honest, there is nothing earth shattering in this, The Daily Stirrer and many other alternative media news and analysis sites have been warning for about two years that Obama's foreign policy was making conflict inevitable. De - dollarization Moves Ahead - Once Again We Told You So,

What Putin Wants

China Warns U.S. to Stop Its Ukrainian Proxy War Against Russia

The World Rejects USA Attempt To Manipulate Venezuela

India's Ruling BJP Party Crushed In Regional Poll

Another Conspiracy Theory Becomes Fact: Oil Collapse Is All About Obama's Proxy War With Russia.

G77 Nations vow to destroy petrodollar and America’s New World Order

American Dollar Dumped

Iran's Oil and the US Dollar

Money From Rock Better Than Money From Air

Currency Wars

Massive Boost To China’s Petro-yuan As Iran Ditches US Dollar In Oil Trade

Iran's oil indistry is one of the most technically advanced.

The ability of the Washington World Domination Party to shoot itself in the foot is legendary, but their latest move, renewal of sanctions on Iran has handed a huge advantage to China’s newly established oil futures market operating on the Shanghai stock exchange, markets analysts say. The sanctions could even make the yuan a better option than than the dollar in the oil markets.

Since the low - key launch in March this year, interest in the gold-backed oil contracts has steadily increased. Traded daily volumes hit a record 250,000 lots last Wednesday, and the share of yuan contracts in global trading jumped to 12 percent compared to eight percent in March.

“The contract is thundering into action,” Stephen Innes, head of trading for Asia/Pacific at futures brokerage OANDA in Singapore, was quoted by Reuters as saying. “It makes sense for Iran to begin selling oil under contracts denominated in yuan rather than dollars.”

It certainly does if the USA sanctions mean Iran cannot sell its oil in Petrodollar dominated markets. China is the largest oil consumer in the world and also buys the most from Iran, a major OPEC producer. Beijing buys 25 percent of Iranian oil exports, which accounts for eight percent of its needs. Plenty of other nations, though smaller markets, are willing to defy the USA and buy Iranian oil on the Shanghai market.

“The sanctions... can potentially accelerate this process of establishing a 3rd (oil) benchmark,” said senior vice president for derivatives in Singapore at financial services firm INTL FCStone, Barry White.

By using more yuan in the oil trade, Beijing both saves the costs of exchanging dollars and promotes the renminbi as a global currency, analysts say. London's financial markets benefit because as the world's leading currency market, the London financial Futures Exchange (LIFFE), instead of simply purchasing dollars to settle accounts, oil buyers will now have to source the currency of the vendor nation, and then supply non Chinese purchasers with Yuan. Last week, Shanghai futures rose to a dollar-converted record high of around $75.40 per barrel, growing faster than rival benchmarks Brent and WTI.

Russia Says Time Has Come To Ditch The Dollar

Saturday 25 August

As the US State Department unveiled the latest round of sanctions on Russia yesterday, while the trade war with China that has seen tariffs imposed on a wide range of Chinese goods shows no sign of easing, Moscow signalled its intention to respond to this latest attack on its economy. In particular, the Russian government announced it is accelerating efforts to abandon the American currency in trade transactions, according to Russia's Deputy Foreign Minister Sergei Ryabkov.

"The time has come when we need to go from words to actions, and get rid of the dollar as a means of mutual settlements, and look for other alternatives," he said in an interview with International Affairs magazine, he told RT.

"Thank God, this is happening, and we will speed up this work,” Ryabkov said, explaining the move would come in addition to other “retaliatory measures” as a response to a growing list of US sanctions. It is time mainstream media in the west started reporting accurately what is going on. The official position of the US is that their sanctions are in retaliation for various Russian acts such as meddling in the US election process, but in reality the USA is trying to protect its position as issuers of the reserve currency, while Russia, China and a number of emerging economies resent the way the US uses the reserve currency to dictate matters in global trade.

Previously, Russian Energy Minister Aleksandr Novak has said that a growing number of countries are interested in replacing the dollar as a medium in global oil trades and other transactions.

“There is a common understanding that we need to move towards the use of national currencies in our settlements. There is a need for this, as well as the wish of the parties,” Novak said.

According to the minister, it concerns both Turkey and Iran, with more countries likely to join the growing dedollarization wave.

Our reporting of this long running news thread tends to confirm his view.

“We are considering an option of payment in national currencies with them. This requires certain adjustments in the financial, economic, and banking sectors,” he said. Last week, we reported that the Kremlin was interested in trading with Ankara using the Russian ruble and the Turkish lira. India has also vowed to pay for Iranian oil in rupees. Some economists argue that modern technology removes the need for a reserve, the speed with which computer systems handle currency trades and conversions eliminated administrative bottlenecks.

Meanwhile, the world’s rapidly growing second-largest economy and Washington's trade nemesis, China, has been taking steps to challenge the greenback's dominance with the launch of an oil futures contract backed by Chinese currency, the petro-yuan. This is fully reported elsewhere in this page. China and Iran have already agreed to stop using the dollar in global trade as China has ramped up purchases of Iranian oil in defiance of US sanctions. India, Pakistan, the EU, Australia and Japan are also known to have made petr-yuan contracts.

RELATED POSTS:NATO Rhetoric About Russian Threat is 'Absurd'

The reasons being given for the latest NATO military buildup in Eastern Europe, the idea that the Russian 'Russian threat' to Eastern Europe grows every day is "simply absurd," according to former US diplomat and Senate policy advisor Jim Jatras. Effectively, Jatras says, the buildup is an attempt by the US to keep Germany and France on board with Washington's world domination agenda and ...

Naked Bankers Go For Gold

... That gold sale in 2013 was a naked short. The seller had no gold to sell. COMEX reported having gold only equal to about half of the short sale in its vaults, and not all of that was available for delivery (quite a lot of it belonged to the german government) In effect the naked shorting of gold could only work because really the right hand was selling to the left hand.

The Demise Of Dollar Hegemony: Russia Breaks Wall Streets's Oil-Price Monopoly In a move that went almost completely unreported in mainstream media, Russia has recently opened a market for the trading of physical and 'paper' oil (futures) in Moscow in Roubles. This is the most blatant challenge yet to the domination of the US dollar in world trade.

WMD in Mayfair

Recalling yesterday's Machiavelli Blog which commented on events surrounding the unfortunate death of the alleged former Russian agent Alexander Litvinenko, it seems the murder investigation has now found evidence of many caches (well OK, traces) of radio active toxins in various fashionable establishments in London's West End frequented by former Russian intelligence agents.

China launches global yuan payment system

China’s Central Bank has started a global payment system which provides cross-border transactions in yuan. The China International Payment System (CIPS) intends to internationalize the yuan and challenge the US dollar's dominance.

Refugee Crisis Or Existential Battle With USA for Europe

It has been clear for some years now that the USA, backed by its main NATO and EU military allies the UK and France (the FUKUS axis has been trying to provoke Russian into firing the shot that will be heard around the world and recognised as the startiung signal for World War Three.

Nothing is ever as it seems to be however, and views from middle east and far eastern journals suggest the USA is also working at destabilizing EU nations in order to force their support in its wars.

The European People’s Party (EPP) is the largest political group in the European Parliament, and they are unerringly supportive of America's efforts to start a war with Russia. “The time of talk and persuasion with Russia is over," MEP and Vice-President of the EPP told a meeting on Tuesday, 21 April, “Now it’s time for a tough policy, and concentration on defence and security ...”

The Mediterranean Boat People Crisis - How Does Europe Deal With The Mediterranean Migrant Crisis

The numbers of migrants trying to cross from the Libya on the coast of north Africa to one of the EU's southern nations is increasing. Europe's impoverished southern nations can't cope. And in the better off nations of northern Europe immigration is a toxic issue which is fuelling the rise of anti EU parties from France to Finnland in the north and Hungary in the east. What can be done?

This Is Why The US Just Lost Its Superpower Status According To Larry Summers

As more and more countries flock to join the Chinese led Asian Infrastructure Investment Bank after Britain, France Australia, India and other traditional US allies defied Washington to associate themselves with China's initiative, conservative economic pundit Larry Summers once a contender for the chairmanship of the Federal Reserve delivered a sharp rebuke ...

The True Debt Disaster America Faces - Only A Fraction Of Government Debt Is Known To The Public

Politicians and the media talk about the $17 trillion debt the US Government owes to creditors. They are lying, the $17 trillion is a fraction of what america owes. The real figure is $200 trillon. And Obama's loonytoons economics are driving that up at an accelerating rate.

U.S. versus Russia War: Top Russian Politics Scolar Stephen Cohen Tells The Truth

We have been blogging for four years about the US drive for war, provocation of Russia in Syria, Iraq, Ukraine and elsewhere made it obvious. But I'm just a news junkie with a strong sense of curiosity and have wondered why the US seems set on this course. Good to see experts like Stephen Cohen, a prominent expert on, Russia are coming onside.

Does It matter If The Dollar Is Replaced?

"Without delving too deeply into Austrian economic and capital theory, just let me point out that money printing disrupts the structure of production by fraudulently changing the “price discovery process” of capitalism. Capital is allocated to projects that will never be profitably completed. Bubbles get created and collapse and businesses are suddenly damaged en mass, thus, destroying wealth. (Zero Hedge)"

What the BRICS plus Germany are really up to in the Currency Wars?

The move led by Russia and China to dump the Petrodollar has escalated into a currency war, not the kind of war we assciate Obama with but give him time. Some wars as in Ukraine, by proxy are not going so well. Others, like the one against Islamic State aka ISIS aka ISIL in the middle east are going worse. Disintegration of The American Economic Empire is manifesting itself in moves by wannabe global players towards creating a multipolar world ...

Europe Prepares To Join The Currency War

Things seemed to be going to plan for the European Unon's single currecncy, The Euro, which was the biggest single step in the plan to merge the twenty eight member states into a single political entity. Ties to the German economic powerhouse the poorer nations of southern Europe could not manage their finances efficiently and soon became dependent on bailouts from the European Central Bank with were made with attached conditions suggested by Germany. It seemed that as long as the German economy prospered the 'European project,' (referred to, a tad unkindly perhaps, by this news site among others as Greater Germany,) would stay on track.

German government spending was actually falling while the trade surplus inceased. Industries that had been nationalized in the socialist 70s were being privatized. The European Central Bank – run by sound money advocate Jean-Claude Trichet – was smarter and more cautious than the reckless money printers of the US Federal Exchange and The Bank of England. The single currency, The Euro, looked for a time as if it was poised to challenge the US dollar as the main global reserve currency as the world mistook stagnation for stability.

Then – with glacial speed and agility at first and now looking more like an avalanche ortsunami every day, both the German economy and European Union fiscal prudence have gone pear shaped.

Mario Draghi, an Italian economist (hardly a recommendation for a banker,) succeeded Trichet as head of the ECB and promised to do “whatever it takes” to generate at least 2% inflation. Then he proceeded to deliver on that promise by buying massive amounts of debt from insolvent EU nations and introducing negative interest rates (i.e. we the punters pay the banks for the privilege of watching them burn our money.)

But the disease was not just financial, inequality – which, we’re now coming to realize – fed by low interest rates and easy money, rose to near-US proportions with the citizens of Greece, Portugal, Ireland and east European nations reduced to penury by the austerities imposed as a condition of ECB loans. Immigration was mishandled to the point that it became the main political issue in many nations and triggered a wave of anti - EU feeling among Europe's working class communities. And populist parties opposed to the existing system started to attract enough votes to gain places in national assemblies and challenge theo cosy, neo - liberal consensus politics of the mainstream parties.

The ruling elites, shocked and frightened by the unwashed masses’ sudden refusal to believe the propaganda and do as they were told, could only respond with massive increases in social spending in an attempt to buy complicity in the destruction of European civilisation, their promises of even easier credit (Draghi actually claimed that there was “plenty of headroom” to cut rates from the current -0.4%) and do whatever it took to preserve the status quo.

Usually austere Germany’s government spending began to skyrocket, jumping from €300 billion to €400 billion in the two years from 2016 and 2018. And now that the Eurosceptic AfD have easten into the Christian Democrats vote now and the far left, spendthrift Greens are contenders for the position of biggest party, things don't look like returning to sanity any time soon.

From today’s Wall Street Journal:To win voters lost to an anti-globalization backlash, Europe’s mainstream parties are going back to the 1970s.

In Germany, the U.K, Denmark, France and Spain, these parties are aiming to reverse decades of pro-market policy and promising greater state control of business and the economy, more welfare benefits, bigger pensions and higher taxes for corporations and the wealthy. Some have discussed nationalizations and expropriations.

It could add up to the biggest shift in economic policy on the continent in decades.

In Germany, Europe’s biggest economy, the government has increased social spending in a bid to stop the exodus of voters to antiestablishment, populist and special-interest parties. Reacting to pressure on both ends of the political spectrum, it passed the largest-ever budget last year.

“The zeitgeist of globalization and liberalization is over,” said Ralf Stegner, vice chairman of the 130-year-old Social Democratic Party, the junior partner in Chancellor Angela Merkel’s government coalition. “The state needs to become much more involved in key areas such as work, pensions and health care.”

The policies mark the end of an era in Europe that started four decades ago, with the ascent of former British Prime Minister Margaret Thatcher and her U.S. ally, President Ronald Reagan.

After Thatcher abolished capital controls in 1979 and began selling off state companies in the 1980s, other European governments followed suit, embracing supply-side policies, deregulation, market liberalization and tax cuts. Revenues from privatization among European Union member states rose from $13 billion in 1990 to $87 billion in 2005, according to Privatization Barometer, a database run by consultancy KPMG Advisory S.p.A.

Today, concerns about growing inequality, stagnating wages, immigration, the debt crisis and China’s rising power have fueled the recent political shift. European businesses and governments also worry about potential changes in U.S. policy, amid looming threats of trade sanctions.

This erosion of the old technocratic consensus about how to run an economy, even in countries where populists aren’t getting any closer to power, could be one the most lasting consequences of the recent antiestablishment surge.

Even in countries where populist parties are already in government, such as Poland, those parties have shifted their focus from nationalist and anti-immigration rhetoric to championing generous welfare policies and state aid.

This reversion to the failed socialist ideas of centralisation and greater government control, coup-led with cultural Marxist attacks on the fabric of societies is spreading throughout Europe and North America as government debt grows and economic growth growth slows. This is how temporary recessions are turned into long term depresions. Borrow too much and the system starts to fail, leading to calls for a return to the good old days of rising benefits and increased government spending paid for with borrowed money.

This time around the only difference is that as the USA and Europe find their currencies undermined by growing debt and rising government expenditure (with social welfare budgets going through the roof,) China, Russia and their allies are waging a currency war on the west aimed at replacing the $US as global reserve currency, as we have reported extensively. China has alreasdy launched the Petroyuan, a non - dollar vehicle for oil trades, and Russia has opened up its own cross border electronic transfer system to rival SWIFT.

The next stage, already visible in Europe, is rising inflation and a currency crisis that wipes out the savings of the people the inflationary policies were supposed to help. The currency war between the US and China will soon be joined by Europe, already talking of its own EFT system and oil currency. The ECB and national central banks will try to undermine the value of the $ on currency exchanges in an effort to prop up the value of the Euro, leaving investors with nowhere to hide but gold. Have you noticed how the price of gold has risen on commodity markets between the beginning of 2019 and now?

RELATED:war can end global US dollar dominance

Petro-yuan: China To Launch Renminbi As Reserve Currency & Take Down Petro-dollar

Why It Really All Comes Down To The Death Of The Petrodollar

Globalisation, The Davosocracy and the Pushbac

Money from fresh air

Things seemed to be going to plan for the European Unon's single currecncy, The Euro, which was the biggest single step in the plan to merge the twenty eight member states into a single political entity. Ties to the German economic powerhouse the poorer nations of southern Europe could not manage their finances efficiently and soon became dependent on bailouts from the European Central Bank with were made with attached conditions suggested by Germany. It seemed that as long as the German economy prospered the 'European project,' (referred to, a tad unkindly perhaps, by this news site among others as Greater Germany,) would stay on track.

German government spending was actually falling while the trade surplus inceased. Industries that had been nationalized in the socialist 70s were being privatized. The European Central Bank – run by sound money advocate Jean-Claude Trichet – was smarter and more cautious than the reckless money printers of the US Federal Exchange and The Bank of England. The single currency, The Euro, looked for a time as if it was poised to challenge the US dollar as the main global reserve currency as the world mistook stagnation for stability.

Then – with glacial speed and agility at first and now looking more like an avalanche ortsunami every day, both the German economy and European Union fiscal prudence have gone pear shaped.

Mario Draghi, an Italian economist (hardly a recommendation for a banker,) succeeded Trichet as head of the ECB and promised to do “whatever it takes” to generate at least 2% inflation. Then he proceeded to deliver on that promise by buying massive amounts of debt from insolvent EU nations and introducing negative interest rates (i.e. we the punters pay the banks for the privilege of watching them burn our money.)

But the disease was not just financial, inequality – which, we’re now coming to realize – fed by low interest rates and easy money, rose to near-US proportions with the citizens of Greece, Portugal, Ireland and east European nations reduced to penury by the austerities imposed as a condition of ECB loans. Immigration was mishandled to the point that it became the main political issue in many nations and triggered a wave of anti - EU feeling among Europe's working class communities. And populist parties opposed to the existing system started to attract enough votes to gain places in national assemblies and challenge theo cosy, neo - liberal consensus politics of the mainstream parties.

The ruling elites, shocked and frightened by the unwashed masses’ sudden refusal to believe the propaganda and do as they were told, could only respond with massive increases in social spending in an attempt to buy complicity in the destruction of European civilisation, their promises of even easier credit (Draghi actually claimed that there was “plenty of headroom” to cut rates from the current -0.4%) and do whatever it took to preserve the status quo.

Usually austere Germany’s government spending began to skyrocket, jumping from €300 billion to €400 billion in the two years from 2016 and 2018. And now that the Eurosceptic AfD have easten into the Christian Democrats vote now and the far left, spendthrift Greens are contenders for the position of biggest party, things don't look like returning to sanity any time soon.

From today’s Wall Street Journal:To win voters lost to an anti-globalization backlash, Europe’s mainstream parties are going back to the 1970s.

In Germany, the U.K, Denmark, France and Spain, these parties are aiming to reverse decades of pro-market policy and promising greater state control of business and the economy, more welfare benefits, bigger pensions and higher taxes for corporations and the wealthy. Some have discussed nationalizations and expropriations.

It could add up to the biggest shift in economic policy on the continent in decades.

In Germany, Europe’s biggest economy, the government has increased social spending in a bid to stop the exodus of voters to antiestablishment, populist and special-interest parties. Reacting to pressure on both ends of the political spectrum, it passed the largest-ever budget last year.

“The zeitgeist of globalization and liberalization is over,” said Ralf Stegner, vice chairman of the 130-year-old Social Democratic Party, the junior partner in Chancellor Angela Merkel’s government coalition. “The state needs to become much more involved in key areas such as work, pensions and health care.”

The policies mark the end of an era in Europe that started four decades ago, with the ascent of former British Prime Minister Margaret Thatcher and her U.S. ally, President Ronald Reagan.

After Thatcher abolished capital controls in 1979 and began selling off state companies in the 1980s, other European governments followed suit, embracing supply-side policies, deregulation, market liberalization and tax cuts. Revenues from privatization among European Union member states rose from $13 billion in 1990 to $87 billion in 2005, according to Privatization Barometer, a database run by consultancy KPMG Advisory S.p.A.

Today, concerns about growing inequality, stagnating wages, immigration, the debt crisis and China’s rising power have fueled the recent political shift. European businesses and governments also worry about potential changes in U.S. policy, amid looming threats of trade sanctions.

This erosion of the old technocratic consensus about how to run an economy, even in countries where populists aren’t getting any closer to power, could be one the most lasting consequences of the recent antiestablishment surge.

Even in countries where populist parties are already in government, such as Poland, those parties have shifted their focus from nationalist and anti-immigration rhetoric to championing generous welfare policies and state aid.

This reversion to the failed socialist ideas of centralisation and greater government control, coup-led with cultural Marxist attacks on the fabric of societies is spreading throughout Europe and North America as government debt grows and economic growth growth slows. This is how temporary recessions are turned into long term depresions. Borrow too much and the system starts to fail, leading to calls for a return to the good old days of rising benefits and increased government spending paid for with borrowed money.

This time around the only difference is that as the USA and Europe find their currencies undermined by growing debt and rising government expenditure (with social welfare budgets going through the roof,) China, Russia and their allies are waging a currency war on the west aimed at replacing the $US as global reserve currency, as we have reported extensively. China has alreasdy launched the Petroyuan, a non - dollar vehicle for oil trades, and Russia has opened up its own cross border electronic transfer system to rival SWIFT.

The next stage, already visible in Europe, is rising inflation and a currency crisis that wipes out the savings of the people the inflationary policies were supposed to help. The currency war between the US and China will soon be joined by Europe, already talking of its own EFT system and oil currency. The ECB and national central banks will try to undermine the value of the $ on currency exchanges in an effort to prop up the value of the Euro, leaving investors with nowhere to hide but gold. Have you noticed how the price of gold has risen on commodity markets between the beginning of 2019 and now?

RELATED:war can end global US dollar dominance

Petro-yuan: China To Launch Renminbi As Reserve Currency & Take Down Petro-dollar

Why It Really All Comes Down To The Death Of The Petrodollar

Globalisation, The Davosocracy and the Pushbac

Money from fresh air

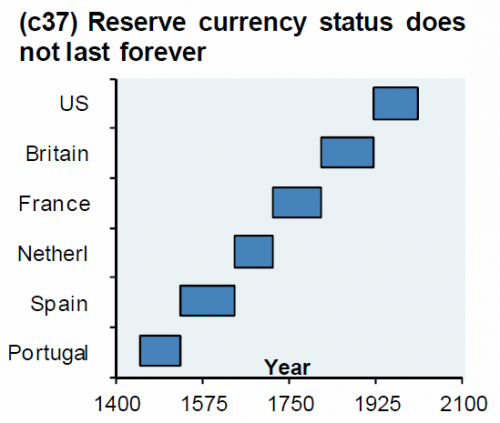

Currency Wars: Former UN Under-Secretary-General Calls For One World Currency

In this page, under the Currency Wars title we have covered US attempts to expolit its position as issurer of the global reserve currency, and the moves bt China, Russia and rest of the BRICS bloc to resist that. Moves to establish the US$ as a true global currency began a long time ago with the creation of the International Monetary Fund at the Bretton Woods conference in the final months of World War 2, with Germany defeated and the world ready to split into capitalist and communist factions. Twenty - five years later, in the midst of the first oil crisis came the creation of the Special Drawing Right (SDR), the IMF’s global reserve asset. And now this:* * * Once again being primed and propagandized to desire this inevitability of globalisation. Coming just a day after the Saudis threatened to end the Petrodollar, Ocampo's op-ed is well-timed to say the least. As we noted previously, nothing lasts forever.When it introduced the SDR, the Fund hoped to make it “the principal reserve asset in the international monetary system.” This remains an unfulfilled ambition; indeed, the SDR is one of the most underused instruments of international cooperation. Nonetheless, better late than never: turning the SDR into a true global currency would yield several benefits for the world’s economy and monetary system. The idea of a global currency is not new. Prior to the Bretton Woods negotiations, John Maynard Keynes suggested the “bancor” as the unit of account of his proposed International Clearing Union. In the 1960s, under the leadership of the Belgian-American economist Robert Triffin, other proposals emerged to address the growing problems created by the dual dollar-gold system that had been established at Bretton Woods. The system finally collapsed in 1971. As a result of those discussions, the IMF approved the SDR in 1967, and included it in its Articles of Agreement two years later. Although the IMF’s issuance of SDRs resembles the creation of national money by central banks, the SDR fulfills only some of the functions of money. True, SDRs are a reserve asset, and thus a store of value. They are also the IMF’s unit of account. But only central banks – mainly in developing countries, though also in developed economies – and a few international institutions use SDRs as a means of exchange to pay each other. The SDR has a number of basic advantages, not least that the IMF can use it as an instrument of international monetary policy in a global economic crisis. In 2009, for example, the IMF issued $250 billion in SDRs to help combat the downturn, following a proposal by the G20. Most importantly, SDRs could also become the basic instrument to finance IMF programs. Until now, the Fund has relied mainly on quota (capital) increases and borrowing from member countries. But quotas have tended to lag behind global economic growth; the last increase was approved in 2010, but the US Congress agreed to it only in 2015. And loans from member countries, the IMF’s main source of new funds (particularly during crises), are not true multilateral instruments. The best alternative would be to turn the IMF into an institution fully financed and managed in its own global currency – a proposal made several decades ago by Jacques Polak, then the Fund’s leading economist. One simple option would be to consider the SDRs that countries hold but have not used as “deposits” at the IMF, which the Fund can use to finance its lending to countries. This would require a change in the Articles of Agreement, because SDRs currently are not held in regular IMF accounts. The Fund could then issue SDRs regularly or, better still, during crises, as in 2009. In the long term, the amount issued must be related to the demand for foreign-exchange reserves. Various economists and the IMF itself have estimated that the Fund could issue $200-300 billion in SDRs per year. Moreover, this would spread the financial benefits (seigniorage) of issuing the global currency across all countries. At present, these benefits accrue only to issuers of national or regional currencies that are used internationally – particularly the US dollar and the euro. More active use of SDRs would also make the international monetary system more independent of US monetary policy. One of the major problems of the global monetary system is that the policy objectives of the US, as the issuer of the world’s main reserve currency, are not always consistent with overall stability in the system. In any case, different national and regional currencies could continue to circulate alongside growing SDR reserves. And a new IMF “substitution account” would allow central banks to exchange their reserves for SDRs, as the US first proposed back in the 1970s. SDRs could also potentially be used in private transactions and to denominate national bonds. But, as the IMF pointed out in its report to the Board in 2018, these “market SDRs,” which would turn the unit into fully-fledged money, are not essential for the reforms proposed here. Nor would SDRs need to be used as a unit of account outside the Fund. The anniversaries of the IMF and the SDR in 2019 are causes for celebration. But they also represent an ideal opportunity to transform the SDR into a true global currency that would strengthen the international monetary system. Policymakers should seize it.

De - Dollarisation: More Nations backing Away From The US$

Image source: www.footagefirm.com

Image source: www.footagefirm.comDe-Dollarization Du Jour: Russia's Largest Bank Issues Yuan-Denominated Guarantees

Leading the charge to multipolarity and de-dollarization are Russia, resugent despite economic sanctions and the rising superpower in waiting, China. The downgrading of the dollar is clearly demonstrated in the launch of the BRICS bank and the establishment of the AIIB. De-Dollarization Accelerates As More Washington "Allies" Follow Australia To China-Led Bank For many years the dollar has been the currency in which the world's nations settled cross-border transactions and the so called petrodollar became the only currency in which oil could be traded. In recent years however, as other nations, particularly the BRICS group, Brazil, Russia, India, China and South Africa, the leading nations outside the dominant US / European group, have been making moves to end the domination of the US dollar. Germany Alarmed by Aggressive NATO Stance On Ukraine As the US pro war rhetoric pumps up the tensions between Russia, its allies and the west in Ukraine we revisit once more the truth about which world power has been relentlessly pushing for war since 2009. It isn't Russia or China, though they are not likely to back down. De-Dollarization Accelerates: Russia Launches SWIFT-Alternative Linking 91 Entities Among the information revealed in The Great Leaks of 2013 were the documents that exposed the extent to which NSA and GCHQ had been secretly 'monitoring' the SWIFT payments system and recording details of cash flowing between nations and organisations. It appears the revelation was the last straws for Russia, China, and other sovereign nations ... Kiev Breaches Minsk Agreement Within Hours We all knew the ceasefire agreed by Angela Merkel, Francoise Hollande, Vladimir Putin and Ukrainian Nazi leader Poroschenko would not hold. The people whose country stands to gain most from war, that is of course Barack Obama and John Kerry, President and secretary of State of the USA, the country that wants and needs perpetual war, were trying derail the fragile deal while the four leaders were still negotiating. India's Ruling BJP Party Crushed In Regional Poll India gets it own UKIP and they are already winning elections as The Common Man party shocks the establishment by tapping into the anger about institutuionalised corruption in the world's biggest democracy Another Conspiracy Theory Becomes Fact: Oil Collapse Is All About Obama's Proxy War With Russia. While we are distracted with sex scandals at home and terrorists rampaging through the middle east and Africa, the US / EU / NATO confrontation with Russia / China / Iran is geting into a very dangerous state. While the Chinese led move to dump the US dollar as global reserve currency is causing economic chaos, the USA attempts to provoke armed conflict with Russia are getting more reckless and desperate. Russia throws down the gauntlet: energy supply to Europe cut off; petrodollar abandoned as currency war escalates There are some big moves taking place on the global stage that you need to know about, as this could all lead to World War III. Yesterday Russia cut off its natural gas supply to Europe, "plunging the continent into an energy crisis 'within hours' as a dispute with Ukraine escalated," the Daily Mail reported. Russia along with three quarters of the world, is isolated The latest EU sanctions announced today after last weeks NATO summit have left Russia increasingly isolated in the world according to mainstream media reports of the response from western governments. Without American leadership, democracy is in peril? Not really. Much of the corporate propaganda spouting mainstream media are forecasting a bad outcome from the current chaose in Ukraine, with ISIS aka ISIL aka Islamic State in Syria and Iraq and the imminent collapse of the petrodollar. The consensus is that the west is currently not winning because of the failure of American leadership. This is untrue, most of the problems exist because America is leading the world towards war. G77 Nations vow to destroy petrodollar and America’s New World Order By leading the G7, G8 and G20 economic groups for the past few decades the US government has managed to exploit its status as holder of the global reserve currency until it appeared on the brink og global economic hegemony. The Americans overplayed their hand however, became too blatant in their bullying of smaller nations and helping corporate interests override national laws. Now the world is closing ranks against the USA. Can't say we're sorry. American Dollar Dumped The status of the US dollar as global reserve currency has kept the Americasn economy afloat for several decades in spite of the US government's vast debt and profligate public spending. It has looked for some time as if rival powers led by the Chinese were getting ready to topple the dollar from supremacy. Iran's Oil and the US Dollar You can't reason with religious fanatics. When the USA (was it the Bush or the Clinton administration?) first imposed economic sanctions on Iran in the hope of turning a medievalist theocracy into a liberal democracy it was always going to backfire. As the US tightened sanctions under Obama, Iran has attacked the USA where it is most vulnerable, taking the initiative in moves to replace the US Dollar as the global reserve currency Money From Rock Better Than Money From Air Strange things are happening in the finance markets, very strange. As the FT and Dow Jones main indexes go up and down faster than a whores knickers, commodity prices are behaving weirdly too.Russian Gold Reserves Hit Putin-Era High, Buying Frenzy Accelerates

The move to dump the US dollar as the main reserve currency for international trade seems to be gatherinmg momenum in spite of US sanctions mania when smaller countries will not obey wasdhington's diktat.

Bloomberg's Yuliya Fedorinova and Olga Tanas report today that the Bank of Russia has more than doubled its monthly gold purchases, bringing the share of bullion in its international reserves to the highest of Putin’s 17 years in power, according to World Gold Council data.

In the second quarter of 2018 alone, Rusia's buying accounted for 38 percent of all gold purchased by central banks. The gold rush is allowing the Bank of Russia to continue growing its reserves while abstaining from purchases of foreign currency for more than two years. It’s one of a handful of central banks to keep the faith as global demand for the precious metal fell to a two-year low in the second quarter.

“Gold is an asset that is independent of any government and, in effect, given what is usually held in reserves, any western government,” said Matthew Turner, metals analyst at Macquarie Group Ltd. in London.

Some pundits are trying to suggest Russia's gold buying is a hedge against further US sanctions or a bid to cut off Russia's access to global financial markets, but in fact Moscow's hoarding of gold goes back a lot further than the current tensions. Russia is of course heavily involved in the creation of a gold backed financial vehicle on the Shanghai financial marke,t planned to act as a rival to the petrodollar.

If Russia’s buying continues at a similar pace, the World Gold Council said the full-year increase in 2018 “could closely match” the 200 tons purchased annually in 2015 and 2016.

At its current pace, Moscow will unseat China for the number five spot of gold-holding nations by the first quarter of 2018.

But China is no slouch, as Reuters reports, China’s proven gold reserves reached 12,100 tonnes at the end of 2016, the state news agency Xinhua reported on Monday quoting an official with the national gold association.

How Russia plans to disentangle its economy from US dollar

Phil T Looker, 6 October, 2018

The Russian Finance Ministry this week officially revealed a plan to end the country's dependence on the US dollar for foreign trade. Economic analysts are warning it will be a long and painful process, but readers familiar with this page will be aware Russia and China, with support from Iran and a number of other oil rich countriies whose oil trade is restricted by US use of the petrodollar to manipulate makets, is several years along the road to economic independence alredy. As well as news updates elsewhere in the page on progress, we have also explained at length how separation from the global reserve currency could be achieved.

According to the plan mentioned above, Russia aims to de-dollarize its economy by 2024. The program is complicated, but a key point is that Russian traders who use roubles instead of dollars would get huge taxation benefits including quicker VAT returns and other incenives to dump the US currency. Russia and China have already signed up some very significant economies, including India, Brazil, Nigeria and Turkey to a system of settling cross border trades in the national currency of the vendor. Another post within this page from 2015 shows how long the process of gathering support for dedollarisation has been under way.

Andrey Perekalsky, an analyst at brokerage company FinIst, told news reporters, “It is necessary to gradually switch to such a system of international payments, which implies payment in rubles for Russia’s best and most popular goods on the world market like oil, gas and arms exclusively.” Currency traders in The City Of London, the world's main currency trading centre will no doubt be delighted to hear that.

Perekalsky added thatRussia should also unite with China and the European Union in creating a payment channel that can’t be controlled by the United States. The alternative to the SWIFT interbank settlement network that could bypass Iranian sanctions could be seen as a first step in that direction. As this page has reported previously, moves are already underway in Russia, China and the EU to create such a system.

Petr Pushkarev, chief analyst at TeleTrade, offers the opinion that Russia with its vast foreign currency reserves (almost $500 billion,) is able to keep the ruble value stable despite the effects of US sanctions mania, which is actually hitting US allies in Europe and Asia which must trade with Russia harder than Russia itself. The currently high prices for crude oil could also help, by increasing Russia's revenue without their having to increase volumes sold.

It appear Russia will diversify not only into rubles, but also use the Chinese yuan - it has been an early supporter of the gold backed petroyuan system set up by China earlier this year to enable oil trades priced in Youan to be conducted on the Shanghai commodity exchange. Deals have also been signed to trade in Vietnamese dong, Indian rupee, and the Euro. The British pound is also involved and has always enjoyed reserve currency status, though in recent decades its role has been minor and restricted mainly to trade between members of the British Commonwealth.

The dollar is pretty much overvalued against the euro; the IMF forecasts a gradual devaluation of the dollar by 10-15 percent,” Pushkarev noted.

“American policy is disliked not only in Russia but by Europe and throughout the third world. There is a widespread feeling that the USA has abused its position as issuer of the main reserve currency to bully smaller nations into trading on terms advantageous to the USA. EU officials have already openly announced that they are starting to create their own system of settlements with Iran, in which transactions will not be transparent to the US authorities and therefore will not be subject to sanctions,” he added.

China's Low Key Launch Of Its Challence To Petrodollar Supremacy

We have been blogging and commenting for several years on moves by Russia, China and Iran to replace the US dollar as the global reserve currency, or at least to create a serious rival to the dollar hegemony. There can be no greater threat to the established order (or to the global banking cartel's dreamed of New World Order,) than the emergence of a serious rival to the dollar. As economic game-changers go there is none bigger or more disruptive than a yuan-denominated settlement system for crude oil contracts, especially when set it is set up up by the largest importer of crude on the planet and the secong largest expoirter of hydrocarbons.

And yet Beijing’s strategy seems to be a softly softly approach. Oil trades are already being conducted in petro-yuan at the Shanghai International Energy Exchange is on hold. This may be related to US sabre rattling and concern that the US deep state, having no economic response to the move may react rashly if presented with a fait accompli. Thus the fact that China and its partners chose to play down the official launch of the new settlement system is understandable. There was room for some euphoria following the launch, Brent Crude soared to $71 a barrel for the first time since 2015. West Texas Intermediate (WTI) reached the highest level in three years at $66.55 a barrel; then retreated to $65.53.

The launch also signalled a series of “firsts” for China's trade links with the west, including the first opportunity for overseas investors to access a Chinese commodity market. Significantly, US dollars will be accepted as deposit and for settlement. In the near future, a basket of currencies will also be accepted as deposit. This is entirely in line with the Sino - Russian policy of moving their economic partners towards condusting trades in the currency of the vendor nation.

Will the launch of the petro-yuan be a deathblow to the petrodollar and U.S. economic dominance and the birth of a new era in trade relations? It will but the change is likely to take years rather than weeks. Many variables have to be considered, the most important being China’s capacity to manipulate and eventually dominate the global oil market.

RELATED POSTS:The Business of War: Defense Sales Keep Economies Of Manufacturing Nations Afloat

Tens of thousands have been killed and millions displaced due to 'humanitarian' interventions by the developed nations (led by the USA, France and the UKm the FUKUS axis) in the domestic politics of third world nation. Usually the interventions support rebel groups who if they came to power would be far more oppressive and brutal regime than the one they replaced.

Naked Bankers Go For Gold

... That gold sale in 2013 was a naked short. The seller had no gold to sell. COMEX reported having gold only equal to about half of the short sale in its vaults, and not all of that was available for delivery (quite a lot of it belonged to the german government) In effect the naked shorting of gold could only work because really the right hand was selling to the left hand.

"West's War In Syria Is Part Of A Global war Waged By The USA And Its Dupes Allies Against Russia"

Arthur Foxake brings us a brilliant analysis of the geopolitical picture from the black Sea and Middle East, but ahead of the embed window we get a few of Arthur's own thoughts on the situation

Russia Just Sent out a Message NATO Should Better Listen To

The key paragraph from the latest official Russian naval doctrine is that Putin and his military advisers have sent a clear message that NATO encroachment is unacceptable. To be honest, there is nothing earth shattering in this, The Daily Stirrer and many other alternative media news and analysis sites have been warning for about two years that Obama's foreign policy was making conflict inevitable.

What Putin Wants

China Warns U.S. to Stop Its Ukrainian Proxy War Against Russia

The World Rejects USA Attempt To Manipulate Venezuela

India's Ruling BJP Party Crushed In Regional Poll

Another Conspiracy Theory Becomes Fact: Oil Collapse Is All About Obama's Proxy War With Russia.

G77 Nations vow to destroy petrodollar and America’s New World Order

American Dollar Dumped

Iran's Oil and the US Dollar

Money From Rock Better Than Money From Air

Strange things are happening in the finance markets, very strange. As the FT and Dow Jones main indexes go up and down faster than a whores knickers, commodity prices are behaving weirdly too. Currency Wars

Back to Contents table

If You Look At How Fast Global Trade Is Unravelling, You'll Get Dizzy

Governments constantly make positive noises about the health of their economies although most people who are in work have felt no improvement on the position they were in after the crash of 2008. Wagest are stangnant, employment has reduced somewhat (see below) and while the banks are printing money and the super rich are widening the gap between themselves and ordinary people faster than ever, the real situation is frightening.

The move by governments to eliminate cash as a means of trading goods and services is moving faster than we imagined. With another global financial crisis looming according to financial journalists and investment experts this is as understandable as it is undesirable for us ordinary punters.

Refugee Crisis Or Existential Battle With USA for Europe

It has been clear for some years now that the USA, backed by its main NATO and EU military allies the UK and France (the FUKUS axis has been trying to provoke Russian into firing the shot that will be heard around the world and recognised as the startiung signal for World War Three.

Nothing is ever as it seems to be however, and views from middle east and far eastern journals suggest the USA is also working at destabilizing EU nations in order to force their support in its wars.

Currency war can end global US dollar dominance & those who own gold have power

The world is facing a currency war and the only hedge against the crash of the US dollar is real gold, a precious metal analyst has said in an interview with RT. With geopolitical power shifting from West to East, US dominance may be ending. "But isn't this just one person's opinion?" you might well ask.

In this particular instance it is, but this page has spent enough time over the past few years reporing on the coming currency war, the move by China, Russia and a group of emerging economic powers including India and Brazil, to abandon the US$ as the reserve currency for international trades to convince even the most gung ho American patriots that something is going on that cannot have a good outcome for their country.

A significant sign that the USA is no longer regarded as the ultimate safe haven is the recent rush tp repatriate physical gold from the United States. In the past twleve months nations including Germany, Turkey, France, The Netherlands, South Korea and Japan have been taking their bullion home. The reason is the Cold War is over and despite the Russiagate scaremongering of neocons and the military - industrial complex, countries don’t see Russia as a threat anymore, says Claudio Grass, an independent precious metals advisor and Mises Ambassador.

The world has been living in crisis since 2008, while a currency war started even earlier, Grass said to RT. Central banks have been creating trillions of dollars out of thin air by issuing bonds, while central banks are coordinating the debasing of currencies, he said.

None of the money printing panic measures implemented since 2008 have made a significant difference, and with sovereign debt still growing it is obvious that the systemic problems still exist. The longer economies remain reliant on debt the greater the risks become and the more fragile the global economy is. More than 65 percent of all monetary reserves in the central banking system are held in the world currency reserve, i.e. in USDollar denominated treasury bonds. Therefore, holding physical gold is definitely the best hedge against a crash of any paper currency, and therefore also against a crash of the USD.

The global economy has become boged down in a “Monopoly-Game” system or a legalised Ponzi scheme that is based on debt and financial leverage.

Russia's Gold Hoard Soars As Trust In Dollar As Reserve Currency Diminished

Leaders greet each other at the St. Petersburg Economic Forum

In spite of the presence of many close US allies, including Japanese Prime Minister Shinzo Abe, French President Emmanuel Macron, China’s Vice President Wang Qishan and IMF chief Christine Lagarde, Vladimir Putin dominated Russia's annual economic showcase.

The Russian president in an unusually outspoken performance, expressed concerns over the erosion of trust and the specter of a global crisis brought on by Washington's disruptions. This probably has a lot to do with the recent launch of the long planned Russian / Chinese alternative to the Petrodollar as a medium for cross border trades.

“The free market and fair competition are being squeezed by confiscations, restrictions, sanctions,” Putin said, in a clear referernce to the use of sanctions by the USA to bully smaller nations into accepting Washington's diktat.

“There are various terms but the meaning is the same -- they’ve become an official part of the trade policy of certain countries. The “spiral” of U.S. penalties is targeting “an ever larger number of countries and companies,” undermining “the current world order,” Putin said.

Macron - who seemed more enamored with Putin than the rest, replied: “I fully share your point of view.”

Putin also expressed frustration at lack of contact with US Predident Donald Trump, blaming the investigation into alleged collusion between Trump's campaign and Russia to influence the 2016 U.S. election. "We are hostages to this internal strife in the United States," Putin said. "I hope that it will end some day and the objective need for the development of Russian-American relationships will prevail."

As Bloomberg reports, the panel had its prickly moments. After Putin suggested that Europe depended on the U.S. for its security, and told Macron there was “no need to worry” because Russia would help, the French president shot back:

“I’m not afraid, because France has an army that knows how to protect itself.”

However, the most ominous signs were from Putin himself as he referred to changes to the unipolar order. In his opening statement at the plenary session, Putin said the global economic order is being undermined and that breaking the rules is becoming the rule of the game. The Daily Stirrer has been reporting on the currency wars being waged by Russia, China and Iran against the USA in reponse to increasing US military belligerence.

Coming a only day after Russia's Finance Minister Anton Siluanov said at the St. Petersburg International Economic Forum that settlements in US currency could be dropped by Russia in favor of the euro, the significance of that threat was unequivocal.

"As we see, restrictions imposed by the American partners are of an extraterritorial nature. The possibility of switching from the US dollar to the euro in settlements depends on Europe’s stance toward Washington’s position,” said Siluanov, who is also Russia’s first deputy prime minister.